Our HSA Eligible Expenses list is free to download and can save you time, money, and headaches when you’re out somewhere and aren’t sure if you can use your HSA funds to cover the cost.

#Hsa eligible expenses 2020 pro#

But don’t worry, we cover examples of ineligible expenses on our list, too! Pro Tip: Keep a List of HSA-Eligible Expenses on Hand However, for your convenience, we’ve created a single page listing specific categories of qualified health care services and products you can pay for with your HSA, like surgical procedures, prescription medications, vision and dental care, lab fees, family planning, medical devices, holistic health care treatments (in certain scenarios), and more.īut before you starting buying pricey equipment for your home gym, keep in mind that some things like exercise gear, cosmetic procedures, and daily hygiene products may not count as qualified expenses-even though they can contribute to your overall wellness.

#Hsa eligible expenses 2020 full#

The list of eligible expenses is extensive, and you can see the full list on our expenses page. We know that you want to make the most of your HSA, and one of the keys to using HSA pre-tax dollars wisely is knowing what health-related expenses qualify. What Can You Spend Your HSA Pre-Tax Dollars On? Unlike a 401(k), however, you can withdraw money from your HSA to spend on eligible medical items and services at any time (and don’t have to pay taxes for them). It can also roll over year to year and move with you throughout your career and into retirement. Just like a 401(k), an HSA earns interest and investment returns.

In some ways, an HSA is comparable to a 401(k), but for health care.

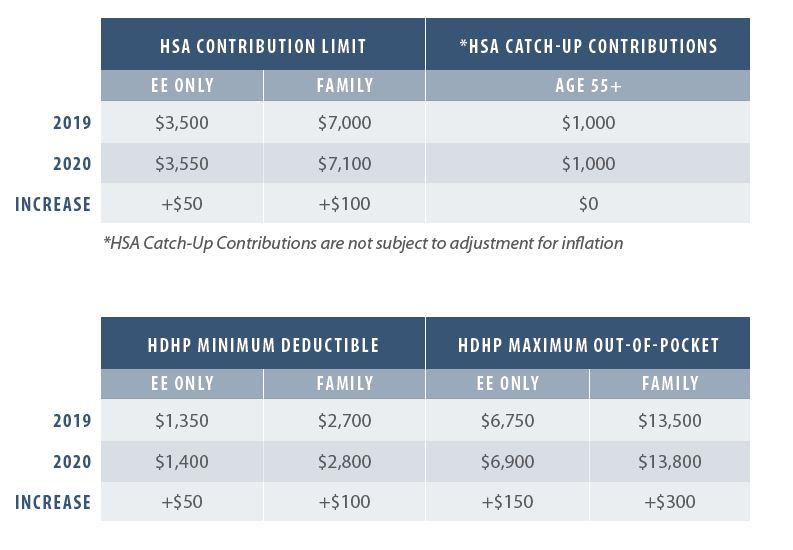

Though HDHPs tend to result in higher out-of-pocket spending, the good news is that you can use HSA funds to cover eligible health costs or to reimburse yourself for qualified expenses you already paid. HSAs are for employees with a high deductible health plan (HDHP). Refresher: What Is a Health Savings Account?Ī Health Savings Account (HSA) allows you to set aside tax-free funds from your monthly paycheck to spend on health-related expenses now, plus save for the future and earn interest on investments along the way.

0 kommentar(er)

0 kommentar(er)